More than 43 percent of Chatham County voters turned out to the polls last Tuesday to weigh in on a number of issues. Nearly 97 percent of them voted “for” or “against” the referendum for a quarter-cent sales tax increase.

Just so happens that more said “for” than “against.”

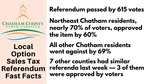

Chatham County joined more than 40 other North Carolina counties — and three others on primary election day — in enacting the Article 46 sales tax, a quarter-cent local option tax on all retail items except for gas and unprepared food like groceries. The decision was tight, a 615-vote margin, to help the county government get more revenue for expenditures like education, agricultural preservation, affordable housing and parks and recreation.

Before moving forward with this new stream of revenue, there are a few things to reflect on as to why this measure passed and how various individuals reacted to it.

Look at the facts

Using the Town of Pittsboro as a central point and dividing the county into four quadrants, the precincts in the northeastern part of Chatham helped lead the way to referendum approval.

Citizens in the northeast quadrant voted for the measure by a 20-point margin, while those in all other quadrants combined to go against the referendum by nearly 69 percent. But the northeast quadrant had 16,160 voters cast ballots last Tuesday, compared to the 6,943 that weighed in from the rest of the county.

Chatham’s primary turnout was third in the state, behind only Orange County (44.87 percent) and Mitchell County (49.51 percent), and higher than the other seven counties — Alamance, Stokes, Forsyth, Madison, Wayne, Bertie and Washington — which had an Article 46 referendum on their ballots.

The turnout numbers didn’t stop some from expressing their disappointment with the results, including Bill Crawford, a member of the Chatham GOP’s executive committee. He wrote in a March 5 Chatham Chatlist post that the Chatham County Board of Commissioners, which includes Republican Andy Wilkie, “placed this on the March ballot instead of November in hopes of having a better shot of passing it.”

But Republicans are not unanimously in favor of general elections when it comes to the timing of the referendum. Wilkie voted in October to place the item on the March 2020 primary ballot, prior to then opposing the same measure in November when it was formalized as an official resolution. Additionally, two all-Republican boards in Alamance and Stokes counties enacted votes on Article 46 sales tax options for their March ballots — both of those measures failed.

Crawford also cited partisan issues, saying the process by which the referendum made it on the ballot “gives stark evidence to how little the Board Democrats think of anyone who disagrees with them.” Joe Coletti, a senior fellow for fiscal and tax policy for the John Locke Foundation, spoke to the right-leaning Carolina Journal in the aftermath of the votes and said county leaders will “cherry pick elections based on voter turnout and political dynamics.”

“It’s not coincidental that tax votes weren’t held during the 2012 primary — when Democrats stayed home and Republicans swarmed the polls to elect a Republican presidential candidate,” stated the article, written by Carolina Journal Assistant Managing Editor Kari Travis. “This year, with a Republican in the White House and an open field of candidates from the opposition party, more Democrats voted while more Republicans stayed home. Those Democrats are more likely to favor tax increases, Coletti said.”

County residents had multiple opportunities to weigh in on whether or not the item would even appear on the ballot. The commissioners first heard discussion on the item at their 2018 board budget retreat and again in 2019. In April 2019, the board asked county staff to begin pursuing the possibility of putting the referendum on the March 2020 ballot, and again discussed it during its July, September and October meetings before officially placing it. Only one person spoke during public comments on the item, and that was specifically to address issues related to sales tax being directed to other counties because of zip code issues and saying that problem should be resolved prior to enacting a sales tax increase.

The county has made multiple attempts to inform the public of that issue and has repeatedly encouraged residents to input their nine-digit zip code when shopping online to make sure sales tax funds go to Chatham.

Responses in favor

Both Commissioners Diana Hales and Karen Howard, the latter being the board’s chairman, responded positively to news of the approval.

“It certainly was an opportunity for Chatham residents to weigh in,” Hales said. “I thought there was sufficient information in the public domain about why the commissioners were very interested in asking for this. It simply will allow us as a county to invest a few more dollars every year.”

Hales said she expected the decision to be “close,” but was pleased with what the funds will be used for, and how they will affect each part of the county.

“Education is front and center in this county,” she said. “Those dollars that will not impact individuals harshly at all will give the county a little more flexibility in building services for the citizenry. Farmland preservation involves the western part of the county. I think that’s a way of distribution to encompass all parts of Chatham. Every one of our parks is going to benefit.”

The county’s Parks and Recreation Comprehensive Master Plan includes proposed improvements to parks ranging from Northwest District in Siler City, Southwest District in Siler City and Earl Thompson in Bynum. Any funds going to schools — particularly in the form of teacher supplements — will likely be spread across the county.

Howard said she found it “heartening” to see “most residents of Chatham” approve a way to address “our affordable housing deficit, educating our children, and preserving and protecting land for agriculture and enjoyment for generations to come.”

“I am happy that the majority of voters were in favor of both referendums on the ballot and am especially pleased with the vote to add a quarter cent to our sales tax rate in the county,” she said. “While it is never an easy decision to seek additional tax revenue, there are times and reasons for which it is essential.”

Susan Levy, the chairman of the county’s Affordable Housing Advisory Committee, said in a statement that the passage of the referendum would aid the county’s efforts in affordable housing “in a meaningful way.”

“The County’s Affordable Housing Advisory Committee recognizes the importance of an ongoing, significant local funding source for affordable housing preservation and development,” Levy said. “The passage of the sales tax referendum by Chatham County voters will help provide that all important funding.”

Crawford said the margin of victory for the election shows that commissioners ignore anyone who disagrees with them.

“There was a significant and vocal opposition that was allowed to speak and then immediately ignored in the path of what the Board of Commissioners thought best all along,” he wrote in his Chatham Chatlist post. “At least with this issue, they have the imprimatur of the referendum to give them legitimacy.”

He then turned to advocate for Republicans Jay Stobbs, Jimmy Pharr and Wilkie to be elected in November.

What’s next

The sales tax option will likely not take effect until October, according to Chatham County Manager Dan LaMontagne.

The county must give citizens a 10-day public notice ahead of the meeting where the commissioners vote to adopt the official resolution to levy the tax. There was not enough time prior to the March 16 meeting, so the board will take that resolution up at the currently-scheduled April 20 meeting. After that, the N.C. Dept. of Revenue must have at least 90 days advance notice before enacting the tax, and the levy can only become effective on the first day of a calendar quarter.

That would make October 1 the soonest the tax increase will go into effect, on the condition the commissioners adopt the resolution in April.

LaMontagne did not take a position for or against the tax, since county employees are not allowed to advocate, but said he was “glad (voters) got to decide.” The projected revenue — a pro-rated amount of about $1.6 million for most of the 2020-2021 budget year — will be included in the upcoming budget, to be presented to commissioners in May.

“Knowing that the referendum has passed, we will be including that as a revenue, an estimated revenue,” he said. “How that is allocated, given the resolution that the board had put in place for the spending of this, has yet to be determined. That’s something we’ll have to get into, the nuts and bolts of where we are.”

The number may fluctuate, he said, based on any trends county officials see in the coming months.

Reporter Zachary Horner can be reached at zhorner@chathamnr.com or on Twitter at @ZachHornerCNR.